What-If Accountants Can Lead The Change For SMEs?

7th April 2020

by Amanda McCulloch

Remember feeling in control of running your business?

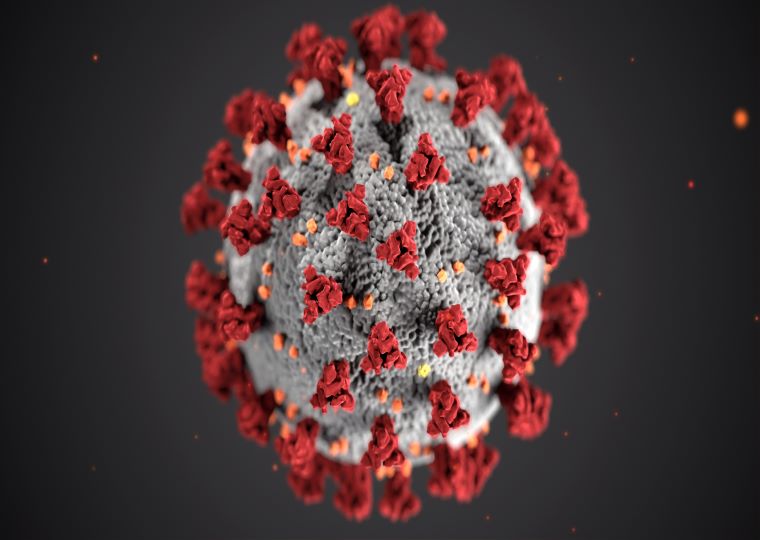

Maybe you still do. Or maybe the double whammy of an oil price slump and Coronavirus crisis has wreaked havoc and, despite knowing your business inside out, you just don't know what the future holds.

The uncertainty and lack of visibility can be immobilising, or perhaps you are making decisions reactively, on a hope and a prayer.

Many things are going to change for businesses in the aftermath of this crisis, and I think the way SME businesses look at scenario planning and contingency planning will be near the top of the list.

I know from personal experience. We have a robust reporting rhythm. We budget, forecast, analyse profit and long-term business plan. We take into account and make contingencies for what we expect to happen. But what about what we don't expect to happen? Let's face it, no-one saw this coming and even the most sensible of assumptions can be wrong.

Does this sound familiar to you?

Once the preserve of large companies with teams of finance analysts and complex algorithms, scenario planning is accessible to every business.

One of the reasons why you might not think it is an option for you is because there's a gap in your perception of what an accountant can offer and, what your business needs. Or, maybe you've got an accountant but they've just never mentioned scenario planning before.

What could it mean for your business to undertake some What-If analysis in a cash flow forecasting exercise right now? What if the analysis provides results worse than expectations, or, lest we forget that we can take positives into consideration too, what if the results are better than expectations?

I'm suggesting it because we are doing it and I know the clarity and certainty it is bringing to our next set of decisions.

Of course, it is not just as simple as a few What-If calculations. A seasoned accountant with expertise in this area will push you much harder than that. But, it should be a push in the right direction.

Choose an advisor who:

- Is a strategic thinker, someone who looks beyond the finance function to the wider business environment.

- Can help you stand back from your business, asking questions you may not have had to answer or face before.

- Will identify the forward looking performance management information that will enable you to make better decisions for your business.

- Is interested in you, your business story and what your business purpose is all about.

- Understands the contribution of human resource management, marketing, technology and every other department in your business.

- Will present recommendations in a compelling way and help you implement the changes (it's likely to be a rough road for some time to come).

Is it going to be expensive? That depends on your perspective. Think about:

- How badly you want to prepare for change.

- Whether you consider "people" or "talent" a cost or an investment for your business.

- This is an advisory position which can be adhoc, temporary or contract in nature.

With a comprehensive scenario plan you can create contingency plans that go beyond offsite data and back up servers. Plans that give you back that sense of control and purpose in your business.

If I can help, just by talking through the business benefits I've experienced of impartial financial advice, please get in touch.

T 01224 327 016